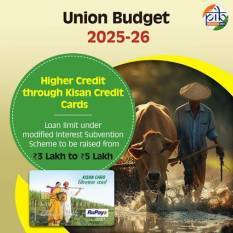

NEW DELHI, 5 February 2025: The Indian government has taken a significant step to bolster its agricultural sector by increasing the loan limit under the Modified Interest Subvention Scheme (MISS) for Kisan Credit Card (KCC) holders from ₹3 lakh to ₹5 lakh.

This announcement, made as part of the Union Budget 2025-26, underscores the government's commitment to empowering farmers and driving agricultural productivity.

Agriculture and allied activities are crucial to India's economy, employing approximately 46.1% of the population. Ensuring access to affordable credit is vital for the financial well-being of farmers. The KCC scheme has played a key role in this effort, providing farmers with access to institutional credit for various needs, including cultivation, post-harvest activities, marketing, household expenses, working capital for farm assets, and investment in allied activities like animal husbandry, dairying, and fisheries. Collateral-free loans up to ₹1.60 lakh are available for these allied activities.

The MISS provides short-term agricultural loans at a concessional 7% interest rate for loans up to ₹3 lakh, with an additional 3% subvention for timely repayment, effectively reducing the interest rate to 4%. This scheme also covers post-harvest loans against Negotiable Warehouse Receipts (NWRs) for small farmers with KCCs.

To enhance transparency and efficiency, the Kisan Rin Portal (KRP) was launched in September 2023. This digital platform streamlines the process of submitting claims for Interest Subvention (IS) and Prompt Repayment Incentive (PRI), eliminating previous delays and inefficiencies associated with manual submissions. As of December 31, 2024, the KRP had processed claims worth ₹108,336.78 crore, benefiting approximately 5.9 crore farmers.

The impact of the KCC scheme is evident in the numbers. As of March 2024, there were 7.75 crore operational KCC accounts with a total outstanding loan amount of ₹9.81 lakh crore. Significant numbers of KCCs have also been issued for fisheries and animal husbandry activities.

Over the past decade, the government's support for agricultural finance has increased substantially. Interest subsidy on KCC loans has grown nearly 2.4 times, from ₹6,000 crore in 2014-15 to ₹14,252 crore in 2023-24. Institutional credit flow to agriculture has also tripled, reaching ₹25.48 lakh crore in 2023-24, compared to ₹8.5 lakh crore in 2014-15. Short-term agricultural credit has more than doubled in the same period. Furthermore, access to agricultural loans for small and marginal farmers has increased significantly, from 57% in 2014-15 to 76% in 2023-24.

The increased KCC loan limit to ₹5 lakh, coupled with other supportive measures, is expected to further empower farmers, boost agricultural growth, and improve rural livelihoods. These initiatives are crucial for building a resilient and self-sufficient agricultural community in India.