COVID, sluggish markets, logistical issues cause decline, but revival in last quarter: MPEDA Chairman

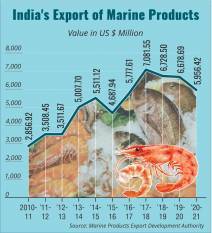

KOCHI, 2 June 2021: The COVID pandemic and sluggish overseas markets cast their shadow over India’s resurgent seafood sector as the country exported 1.149 million tonne (11,49,341 metric tonne) of marine products worth INR 43,717.26 crore (US$ 5.96 billion) during FY 2020-21, registering a contraction of 10.88 per cent in volume as compared to a year earlier.

USA, China and the European Union (EU) were the leading importers, while frozen shrimp retained its position as the major export item followed by frozen fish.

During 2019-20, India exported 1.28 million tonne (12,89,651 metric tonne) of seafood worth INR 46,662.85 crore (USD $6.68 billion), marking a decline of 6.31 per cent in rupee terms and 10.81 per cent in dollar value in 2020-21.

Speaking on this, Marine Products Export Development Authority (MPEDA) chairman K S Srinivas said, “The pandemic drastically affected seafood exports during the first half of the year, but it revived well in the last quarter of 2020-21. Also, the aquaculture sector performed better during this fiscal by contributing 67.99 per cent of exported items in dollar terms and 46.45 per cent in quantity, which is 4.41 per cent and 2.48 per cent higher, respectively when compared to 2019-20.”

Frozen shrimps contributed 74.31 percent to exports earnings

Frozen shrimp contributed 51.36 per cent in quantity and 74.31 per cent of the total dollar earnings. USA remained its largest importer (272,041 metric tonne), followed by China (101,846 metric tonne), EU (70,133 metric tonne), Japan (40,502 metric tonne), South East Asia (38,389 metric tonne), and the Middle East (29,108 metric tonne).

However, shrimp exports declined by 9.47 per cent in dollar value and 9.50 per cent in quantity. The overall shrimps export was 590,275 metric tonne worth USD $ 4.42 billion (4,426.19 million dollars).

The export of Vannamei (whiteleg) shrimp decreased from 512,204 metric tonne to 492,271 metric tonne in 2020-21. Of the total Vannamei shrimp exports in dollar value, 56.37 per cent was exported to USA, followed by China (15.13 per cent), EU (7.83 per cent), South East Asia (5.76 per cent), Japan (4.96 per cent) and the Middle East (3.59 per cent).

Japan major export market for black tiger shrimps

Japan, the major market for Black Tiger (Penaeus monodon) shrimp, had a share of 39.68 per cent in dollar terms, followed by USA (26.03 per cent), South East Asia (9.32 per cent), EU (8.95 percent), the Middle East (6.04 per cent) and China (3.76 per cent).

Frozen fish, with a share of 16.37 per cent in quantity and 6.75 per cent in dollar earnings, retained the second position in exports basket though its shipments plummeted by 15.76 per cent in quantity and 21.67 per cent in dollar terms.

‘Other Items’, the third largest category that largely comprised Surimi (fish paste) and Surimi analogue (imitation)products, showed a marginal growth of 0.12 per cent and 0.26 per cent by quantity and rupee value, respectively, but declined in dollar terms by 5.02 per cent.

Frozen squid and frozen cuttlefish exports declined in volume by 30.19 per cent and 16.38 per cent, respectively. However, dried items showed an increase of 1.47 per cent and 17 per cent in quantity and rupee value, respectively.

Reduced air cargo connectivity due to pandemic impacted shipments of chilled items, live items

Shipments of chilled items and live items, which were negatively affected due to the reduced air cargo connectivity in the pandemic situation, fell by 16.89 per cent and 39.91 per cent in volume, respectively.

Capture fisheries contribution reduced from 56.03 per cent to 53.55 per cent in quantity and from 36.42 per cent to 32.01 per cent in dollar value. However, tilapia and ornamental fish performed well with 55.83 per cent and 66.55 per cent increase in quantity and an uptick of 38.07 per cent and 14.63 per cent in dollar earnings, respectively. Tuna showed 14.6 per cent increase in quantity, but its dollar earnings downed by 7.39 per cent. Crab and scampi exports reduced both in quantity and value.

USA imports accounted 41.15 percent of Indian seafood

USA, with imports of 291,948 metric tonne, continued to be the major importer of Indian seafood with a share of 41.15 per cent in dollar terms. Exports to that country grew by 0.48 percent in rupee value but declined by 4.34 per cent and 4.35 per cent in quantity and dollar terms, respectively.

Frozen shrimp remained the principal item exported to USA while exports of Vannamei shrimp showed an uptick of 6.75 per cent in quantity. However, its import of Black Tiger shrimps decreased by 70.96 per cent and 65.24 per cent in quantity and dollar terms, respectively.

China second largest market with 218,343 metric tonne imports

China, with an import of 2,18,343 metric tonne of seafood worth USD $939.17 million dollars, remained the second largest market with a share of 15.77 per cent in dollar earnings and 19 per cent in quantity terms. However, exports to this country declined by 33.73 per cent and 31.68 per cent in quantity and dollar terms, respectively. Frozen shrimp was the major item of exports to China, accounting for a share of 46.64 per cent in quantity and 61.87 per cent in dollar earnings.

EU, the third largest destination with a share of 13.80 per cent in dollar value, imported frozen shrimp as the major item. However, export of frozen shrimp to EU countries decreased by 5.27 per cent and 6.48 per cent in quantity and dollar value, respectively.

Exports to South East Asia had a share of 11.17 per cent in dollar value. However, it declined by 2.56 per cent in quantity and 5.73 per cent in dollar earnings. Shipments to Japan, the fifth largest importer with a share of 6.92 per cent in dollar terms, grew by 10.52 per cent in quantity but declined by 2.42 per cent in dollar value.

Exports to Middle East declined by 15.30 percent

The Middle East, the sixth largest destination with a share of 4.22 per cent in dollar value, declined by 15.30 per cent and 15.51 per cent in quantity and dollar terms, respectively. Frozen shrimp was the major item of exports, having a share of 72.23 per cent in dollar terms.

Srinivas said besides the pandemic impact, several other factors negatively impacted seafood exports during 2020-21. On the production side, there were reduced fish landings due to less number of fishing days, slow logistic movements and market uncertainties. Scarcity of workers in fishing and processing plants, paucity of containers at seaports, increased air freight charges and limited flight availability affected exports, especially of high-value chilled and live products.

The situation in overseas market was another dampener. In China, container shortage, increased freight charges, and COVID testing on seafood consignments caused market uncertainties. In USA, scarcity of containers made it difficult for exporters to execute orders in time. Closure of HoReCa (hotel, restaurant and café) segment also affected the demand. In Japan and EU, COVID-induced lockdowns made the retail, restaurant, supermarkets and hotel consumption sluggish, MPEDA said in a statement.