NEW DELHI, 09 January 2019 : With a view to ensuring availability of agriculture credit {including loans taken against Kisan Credit Card (KCC)} at a reasonable cost/at a reduced rate of 7% per annum to farmers, the Government of India, is implementing an interest subvention scheme of 2% for short term crop loans up to INR 300,000.

The scheme is implemented through public sector banks and private sector banks {reimbursement through Reserve Bank of India (RBI)}, Regional Rural Banks and Cooperatives {reimbursement through National Bank for Agriculture and Rural Development (NABARD)}.

Currently, besides 2% interest subvention, the farmers, on prompt repayment of crop loans on or before the due date, are also provided 3% additional interest subvention.

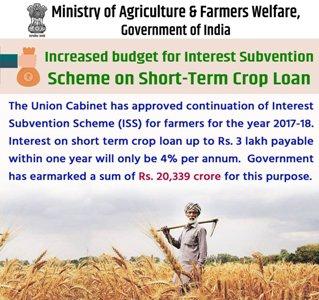

Thus, in case of prompt payee farmers the short term crop loans are provided at an effective interest rate of 4% per annum. The benefit of interest subvention is extended for a period of up to six months (post-harvest) to small and marginal farmers having KCC on loan against negotiable warehouse receipts with the purpose of preventing distress sale of produce.

As per the extant policy crop loans up to INR 300,000 per farmer provided by District Central Co-operative Banks and Primary Agricultural Co-operative Societies at 7% per annum are eligible for refinance (through State Cooperative Banks/District Central Co-operative Banks) from National Bank for Agriculture and Rural Development (NABARD) out of Short Term Cooperative Rural Credit (STCRC) fund allocated by Government of India every year.

In terms of the extant Interest Subvention Scheme on short-term crop loans, loans are made available to the farmer at 7% per annum and on prompt repayment an incentive of 3% is credited to the farmer’s account.

While the benefit of interest subvention is passed on upfront to the borrower farmer by banks, the reimbursement of audited claims received from banks through Reserve Bank of India in respect of Commercial Banks and NABARD in respect of Cooperative Banks and Regional Rural Banks is made by Government of India on the basis of available budgetary resources.

Presently, Union Government is not considering any proposal to provide funds equal to 90% of the interest subvention to the financial institutions as advance.

This Information was given by the Minister of State for Ministry of Agriculture & Farmers Welfare Shri Parshottam Rupala in Lok Sabha on Janury 8, 2019.